Setting an example to the districts, the Budapest City Council will introduce a value-based building tax on Margit Island, which it directly administers: from 1 January, a 1 per cent tax must be paid on private luxury properties worth more than one billion forints, the General Assembly decided on Wednesday. The proposal was tabled by Mayor Gergely Karácsony and was approved by the representatives with 18 votes in favour, 12 against, and 2 abstentions, reports MTI.

With the adoption of the proposal, the body asked Gergely Karácsony to make a proposal to the district local councils to review their building tax regulations and to abolish any tax exemption for apartments with a market value of more than one billion forints.

The representatives also asked the Mayor to initiate an amendment to the law on local taxes with the government that would allow local councils to introduce the building tax in such a way that the tax base below a corrected sales value can be the floor area, while the tax base above a corrected sales value can be the corrected sales value.

In the accepted proposal, it can be read that most local councils have introduced a building tax on useful floor areas with relatively simple administration, typically exempting private taxpayers from building tax in the case of buildings classified as apartments, regardless of their value.

"However, in my opinion, the value-based building tax is more consistent with the constitutional principle of proportional public burden-bearing and social justice. The tax levied on the floor area does not take into account the real value of the property, so a higher tax is to be paid for a building with a large floor area but of low value, than for a luxury property with a smaller floor area but of outstanding value. This rightfully violates society's sense of justice," said Gergely Karácsony.

He wrote that the public asks the 1 per cent with the largest wealth to contribute 1 per cent of the value of their residential properties over one billion forints to public services and to meet community needs every year, while for 99 per cent of society, the housing tax exemption will remain unchanged.

"The effective tax rate of 1 per cent for those who acquired their wealth honestly does not represent a meaningful burden, and those who, as oligarchs, have accumulated real estate wealth in violation of society's moral sense, it is hardly unjust to be more involved in public burden-bearing," the document states.

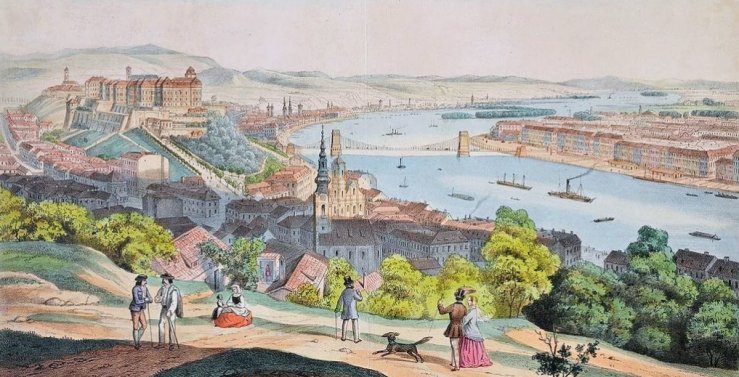

Margit Island (Photo: Balázs Both/pestbuda.hu)

The Mayor drew attention to the fact that, in the current legal environment, the path chosen by the Budapest City Council is not acceptable for the district local councils, as determining the corrected sales value of each building would be a significant administrative burden for them. However, they also have the opportunity to further enforce the aspects of social justice by cancelling the exemption from the itemised building tax, which is typically granted to apartments owned by private individuals, in the case of apartments with a market value of over one billion forints - Gergely Karácsony pointed out in the document.

According to his explanation, this does not mean in their case a transition to the corrected sales value-based building tax, it would only result in the narrowing of the current tax exemption so private owners of high-value luxury apartments should pay building tax per square metre of useful floor area. The capital draws the attention of the districts to this possibility within the scope of the right of referral.

The proposal reads: the low number of taxable buildings on Margit Island also means that the additional income from the value-based building tax will not be outstanding – compared to the entire budget of the Budapest City Council. An exact estimate for this cannot be given for two reasons: on the one hand, the market value of the taxable objects is currently unknown, and on the other hand, it is not legally possible to determine it in advance, since due to the small number of affected properties, their identification without violating tax confidentiality is not legally possible.

Péter Kovács (Fidesz–KDNP), the mayor of the 16th District, said that he does not understand why they want to destroy the companies, because for the 13th District, for example, it would be a tax increase of 500-1000 per cent with the introduction of this type of tax.

According to Zsolt Wintermantel, the leader of the Fidesz-KDNP faction in the capital, if the imposition of the tax only applies to Margit Island and the districts do not introduce it, then the "Karácsony Tax" is just a political bluff.

Deputy Mayor of Budapest Ambrus Kiss emphasised that according to the mayoral candidate program, the rich have a greater responsibility in carrying public burdens, and this requires a greater contribution.

Gábor Bagdy (Fidesz–KDNP) spoke about the fact that there are a number of contradictions in the proposal, which, according to him, does not achieve the proposed goal.

Tamás Soproni (Momentum), the mayor of the 6th district, called it strange that Fidesz representatives talk about the value-based construction tax as something mystical, while it is an existing tax. There are similar ones in Nyíregyháza and Paks, the politician noted, stating that he supports the Mayor's idea for a fairer public burden.

Source: MTI

Cover photo: The capital imposed building tax on Margit Island (Photo: Balázs Both/pestbuda.hu)

Hozzászólások

Log in or register to comment!

Login Registration